Anchoring inflation expectations is a priority for central banks worldwide, including RBI. While central bank’s target long-term inflation expectations, short-term inflation expectations (3 months and 1-year ahead) also significantly influence the dynamics of the macroeconomic variables. The importance of short-term inflation expectations is pronounced during turbulent times such as financial crises (Global Financial Crisis, 2008), collapse of banks or emergencies such as the COVID pandemic in 2020, etc. This is when a country’s central bank tries to steer the expectations through non-conventional channels such as announcements, instead of cutting the interest rate as usual.

Inflation expectations of Rural areas

RBI has been conducting the Inflation Expectations Survey on Households, to collect data on the household inflation expectations bi-monthly. One very pertinent observation is that the survey is usually conducted in major cities or urban areas, with no inclusion of the rural areas. A quick pilot survey indicates that the inflation expectations of the rural areas might not be the same as those of the urban areas. We conducted a pilot survey in two remote villages of the Guntur District of Andhra Pradesh using the same questionnaire used by the RBI, including two additional questions – Do you know of RBI? Do you follow their projections?

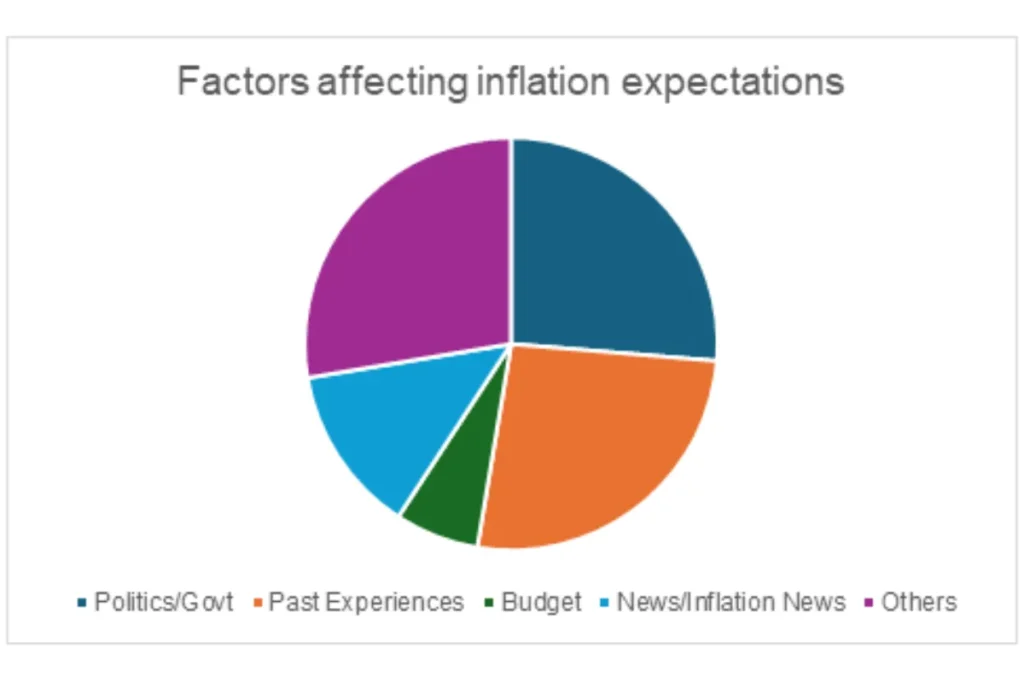

The answers to both the questions were varied and have been presented as a pie chart below:

We find that more than 65 percent of the survey participants either have no idea of RBI projects or do not follow the projections in forming their expectations. One of the factors that were cited frequently, as the determinants of inflation expectations is the influence of political news or government in power (partisan bias). Studies on advanced economies record similar findings, with people reporting stable or decreasing levels of inflation expectations if the political party that they favor is in power, irrespective of economic progress.

What does this mean for the RBI and its independence?

If the results hold true at a national level or even state level, then, RBI might not be able to effectively manage inflation expectations in the near-term (specifically during crises). Additionally, it may also mean that the RBI is not yet perceived as an independent body influencing the inflation level. Economic agents might consider government as driving inflation expectations or influencing the decisions taken by the RBI.

The implications are clear as a day, that RBI must implement effective communication strategies, increase the frequency of the communication and reach out to the masses using non-formal channels.

By – Dr. Adviti D, Assistant Professor, Economics, SRM University, AP

Keep watching our YouTube Channel ‘DNP INDIA’. Also, please subscribe and follow us on FACEBOOK, INSTAGRAM, and TWITTER.